Bank of Canada Interest Rate Policy in 2025: Impacts on Growth and Inflation

The interest rate decisions of the Bank of Canada (BoC) in 2025 are shaping the nation’s economic trajectory, threading a delicate needle between fostering growth and taming inflation.

With the policy rate holding steady at 2.75%, the central bank faces a high-stakes balancing act.

Global trade uncertainties, particularly U.S. tariffs, loom large, while domestic pressures like housing costs and consumer spending add complexity.

This article unpacks how the BoC’s approach influences Canada’s economic landscape, offering fresh insights into its ripple effects on businesses, households, and the broader market.

As the economic landscape continues to evolve, understanding the BoC’s policies will be crucial for Canadians looking to navigate their financial futures effectively.

Navigating a Trade-War Tightrope

Imagine the Canadian economy as a canoe gliding through choppy waters—U.S. tariffs are the swirling currents threatening to tip it over.

The BoC’s decision to pause rate cuts in April 2025 reflects caution amid this turbulence.

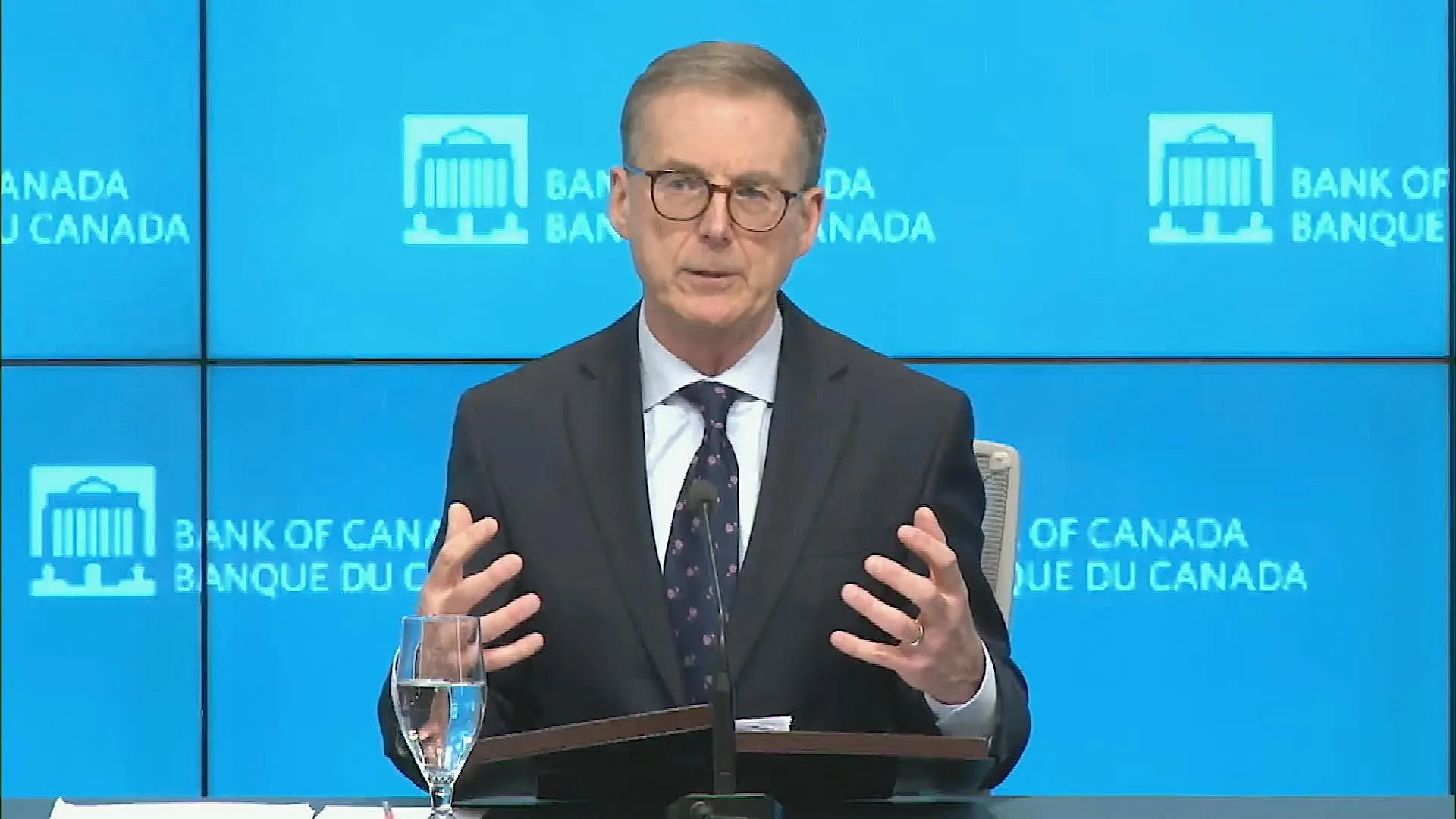

Governor Tiff Macklem has emphasized that monetary policy cannot directly counter trade disruptions but can stabilize prices and support growth.

By holding the interest rate at 2.75%, the BoC aims to anchor inflation expectations while monitoring how tariffs impact exports and consumer prices.

Trade tensions have already dented confidence.

Businesses, wary of higher costs, are scaling back investment.

For example, a Toronto-based manufacturer, MapleTech Industries, recently delayed a $10 million factory expansion due to fears of tariff-driven cost spikes.

This hesitation ripples through supply chains, curbing job creation and economic momentum.

The BoC projects first-quarter GDP growth at 1.8%, but second-quarter forecasts are murkier, with some scenarios suggesting near-zero growth if tariffs persist.

To stay updated on trade policies, you can visit Global Affairs Canada.

Inflation: A Persistent Shadow

Rising shelter costs remain a stubborn driver of inflation, pushing the Consumer Price Index (CPI) to 2.3% in March 2025.

The BoC’s target range of 1–3% is under pressure as housing shortages collide with population growth.

Lower interest rates could fuel demand, but the current pause signals a preference for stability over stimulus.

Macklem’s team is betting that inflation will dip to 1.5% in April, partly due to the removal of the consumer carbon tax, but risks linger.

Consider Sarah, a Vancouver nurse renewing her mortgage in 2025.

Her fixed-rate loan from 2020, secured at 1.9%, now faces renewal at 4.5%.

Higher monthly payments squeeze her budget, forcing cuts to discretionary spending.

Multiply this by millions of households, and consumer demand softens, easing inflationary pressure but slowing growth.

The BoC’s steady interest rate stance aims to prevent a spiral where rising costs outpace wages, but it also risks stifling economic activity.

Moreover, understanding the underlying factors driving inflation can help Canadians make informed financial decisions in these challenging times.

Growth: A Fragile Recovery

Canada’s economy ended 2024 on a high note, with 5.6% growth in the final quarter, driven by robust household spending.

Yet, 2025 paints a different picture.

The BoC’s April Monetary Policy Report outlines two scenarios: one where tariffs are negotiated away, yielding moderate growth, and another where a prolonged trade war triggers a recession with inflation spiking above 3%.

The interest rate hold at 2.75% reflects a wait-and-see approach, prioritizing data over hasty cuts.

Business investment is a key concern.

A March 2025 survey by the Canadian Federation of Independent Business found that 62% of small firms planned to reduce capital spending due to economic uncertainty.

This pullback threatens long-term productivity.

For instance, a Calgary software startup, CodeWave, shelved plans for a new office, citing borrowing costs and tariff-related risks.

Such decisions amplify the growth slowdown, challenging the BoC’s goal of sustained expansion.

In light of these challenges, businesses must assess their strategies to adapt to changing economic conditions effectively.

The Housing Market Conundrum

Why does the housing market keep policymakers awake at night?

It’s a pressure cooker of supply shortages and affordability woes.

Lower interest rates could ignite demand, pushing prices higher, but the current pause keeps borrowing costs elevated.

The Canadian Real Estate Association (CREA) projects flat home sales in 2025, revising earlier forecasts of an 8.6% surge.

This stagnation reflects caution among buyers facing high mortgage rates and economic uncertainty.

The table below illustrates the impact of mortgage rate changes on a typical $500,000 loan:

+ Personal Finance Strategies in Canada for 2025: Digital Tools and Economic Trends

Mortgage Rate Changes Impact

| Mortgage Term | Rate (2020) | Rate (2025) | Monthly Payment (2020) | Monthly Payment (2025) | Annual Increase |

|---|---|---|---|---|---|

| 5-Year Fixed | 1.9% | 4.5% | $2,082 | $2,792 | $8,520 |

| Variable Rate | 1.5% | 3.5% | $2,000 | $2,550 | $6,600 |

This jump in payments strains household budgets, curbing spending on goods and services.

The BoC’s interest rate strategy must weigh these dynamics, ensuring affordability without overheating the market.

Additionally, potential homebuyers should remain vigilant about market trends to make informed decisions.

Employment and Wages: A Double-Edged Sword

Employment data paints a mixed picture.

March 2025 saw job losses, with businesses signaling slower hiring due to trade tensions.

Unemployment rose to 6.8%, a worrying uptick from 6.5% in late 2024.

Wage growth, meanwhile, is moderating, which helps contain inflation but limits consumer purchasing power.

The BoC’s steady interest rate policy aims to support job creation without sparking wage-price spirals.

The interplay of these factors is critical.

A robust labor market fuels spending, but persistent inflation could force the BoC to tighten policy, risking layoffs.

The table below summarizes labor market trends:

Labor Market Trends

| Metric | Q4 2024 | Q1 2025 | Projected Q2 2025 |

|---|---|---|---|

| Unemployment Rate | 6.5% | 6.8% | 7.0% |

| Job Creation (000s) | +50 | -10 | 0 |

| Wage Growth (Annual) | 3.2% | 2.8% | 2.5% |

These trends underscore the BoC’s challenge: stimulating growth without reigniting inflation.

As the labor market evolves, individuals must stay proactive in their career development to mitigate risks.

Global Context: A Web of Influences

Canada’s economy doesn’t exist in a vacuum.

U.S. tariffs, projected to raise inflation while slowing growth, complicate the BoC’s calculus.

The Federal Reserve’s decision to hold rates at 4.25–4.5% signals caution, limiting the BoC’s room to maneuver.

A weaker Canadian dollar, potentially falling to $0.64–$0.65 USD, raises import costs, adding inflationary pressure.

The BoC’s interest rate pause reflects a pragmatic response to these external forces.

Globally, central banks face similar dilemmas.

The Bank of England anticipates four rate cuts in 2025, aiming for 2.75% by mid-2026, while the Bank of Japan holds steady at 0.5%, grappling with export risks.

These divergent paths highlight the BoC’s unique position: balancing domestic needs with global headwinds.

Understanding these global influences can help Canadians better prepare for potential economic shifts.

++ Resale Market Thrives Amid US Tariffs and Economic Uncertainty

Policy Implications: Striking a Balance

The BoC’s cautious stance has sparked debate.

Some economists argue for deeper cuts to spur growth, citing weakening demand and job losses.

Others warn that premature easing could reignite inflation, especially if tariffs drive up costs.

Macklem’s emphasis on “proceeding carefully” suggests a data-driven approach, with the next rate announcement on June 4, 2025, as a pivotal moment.

Two scenarios dominate the BoC’s outlook.

In the optimistic case, tariff relief boosts confidence, allowing gradual rate cuts to support growth.

In the pessimistic scenario, a trade war triggers a recession, forcing the BoC to choose between fighting inflation or cushioning the downturn.

The interest rate hold buys time to assess which path unfolds.

As policymakers navigate these complexities, public communication will be essential for maintaining trust and clarity.

Looking Ahead: Opportunities and Risks

The BoC’s strategy hinges on adaptability.

If inflation remains near 2% and trade tensions ease, rate cuts could resume, boosting investment and consumer confidence.

However, persistent inflation or a deeper slowdown could force a rethink.

Businesses and households must navigate this uncertainty, planning for multiple outcomes.

For policymakers, the challenge is clear: maintain credibility while fostering resilience.

The BoC’s ability to communicate its rationale—balancing growth, inflation, and external shocks—will shape public trust.

As Macklem noted, “Forecasts are of little use” in such uncertainty, underscoring the need for agility.

Maintaining an awareness of economic indicators will be crucial for Canadians trying to navigate the evolving landscape.

Conclusion: A Pivotal Year for Canada

The Bank of Canada’s interest rate policy in 2025 is a linchpin for economic stability.

By holding rates at 2.75%, the BoC navigates a landscape of trade risks, housing pressures, and employment challenges.

Its decisions will ripple through businesses like MapleTech, households like Sarah’s, and the broader economy.

As Canada faces a pivotal year, the BoC’s steady hand offers a foundation for resilience, but the path ahead demands vigilance and adaptability.

In conclusion, staying informed and proactive will be essential for Canadians as they navigate the complexities of the economic landscape in 2025.

Sources:

- Canadian Real Estate Association (CREA), 2025 Housing Market Forecast

- Bank of Canada Monetary Policy Report, April 2025

- Canadian Federation of Independent Business Survey, March 2025